The interest rate at which the Federal Reserve lends money to commercial banks and other depository institutions is known as the discount rate. This rate is established by the Federal Reserve. By adjusting the discount rate, central bank like the Fed can decrease the pressures of reserve requirement and liquidity difficulties, control the money supply in the economy, and ensure stability in the financial markets.

The Workings Behind The Federal Discount Rate

Fed banks can lend directly to financial companies and other depositories, in addition to the various tools it utilizes for monetary policy and regulation monitoring. Keeping the financial sector and individual institutions stable is central to the Fed's role as lender of last resort.

Healthy banks are permitted to borrow an unlimited amount of money at very short maturities (typically overnight) from the Fed's discount window, which is why this facility is often referred to as a standing lending facility. This policy is in place to prevent unnecessary bank collapses.

Why Is It Necessary For Banks To Keep Reserves?

As part of what is known as the reserve requirement, the Federal Reserve mandates that banks maintain a particular level of liquid assets at all times. Banks that made excessive loans on that specific day must borrow funds overnight to satisfy the reserve requirement.

The majority of the time, they borrow from one another. The Fed makes the discount window available if they cannot acquire the funds through any other means.

How Come The Fed Needs A Reserve?

One of the reasons for this is that it contributes to the continued solvency of banks (the ability to pay off debts). The Federal Reserve requires banks to maintain reserves to exert control over the total quantity of money, credit, and other types of capital that these institutions can lend out. If the bank is required to have a large reserve, then less money will be available for loans.

Modifying Monetary Policy and The Discount Rate

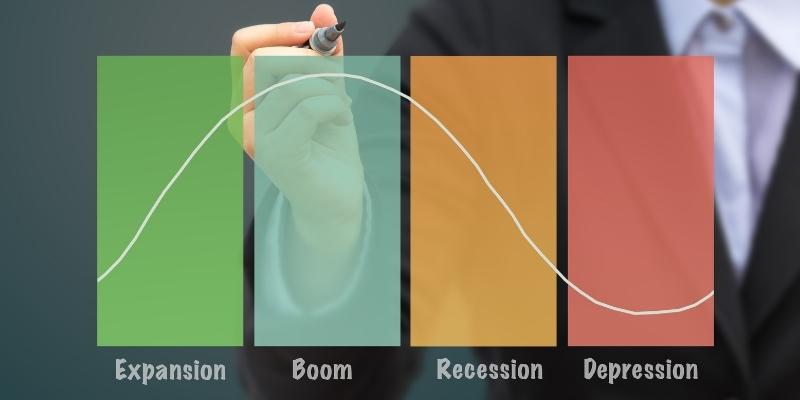

In addition to preventing bank failures, a federal discount rate is a tool that either stimulates or slows the economy, depending on the desired outcome. When the discount rate is lowered, it becomes less expensive for commercial banks to borrow money.

This, in turn, leads to a rise in the amount of credit that is accessible and the amount of lending activity that occurs across the economy. In contrast, an increase in the discount rate makes it more expensive for banks to borrow money, reducing the number of funds available and the amount of investment activity.

Implications Of The Discount Rate On The Economy

All of these interest rates are impacted in some way by the discount rate:

Adjustable-rate loans and credit cards are affected by the London Interbank Offered Rate (LIBOR), which is the cost of borrowing banks pay each other for loans with maturities of one month, 3 months, six months, and a year. The prime rate is the interest rate banks charge their most valuable customers; it affects all other interest rates.

Different Variations Of The Federal Discount Rates

The FOMC determines the following discount rates:

The primary credit rate, also known as the introductory interest rate, is typically higher than the federal funds rate. This is because the primary credit rate is the rate that is charged to the majority of banks.

Half a point often increases the primary credit rate, and the secondary credit rate is typically more significant than the introductory credit rate. The secondary credit rate is charged to banks that do not meet the conditions for the initial rate.

Fed Funds Rate vs. Fed Discount Rate

The interest rate that the Fed applies to loans is referred to as the federal discount rate. It should not be confused with the federal funds rate, which is the interest rate that financial institutions charge for loans utilized to fulfill reserve requirements.

In contrast to the federal funds rate, which is determined by market forces amongst Fed member banks, the discount rate is established by the board of governors of the Federal Reserve System.

Discount Rate Example

FOMC meets eight times a year to modify the discount rate. The discount rate helps control inflation and adjust the economy through monetary policy. This is the lowest discount rate in FOMC history; it will likely be renewed or marginally altered until the Committee reaches its aim of 2% inflation.